24+ mortgage interest taxes

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Section 24 Buy To Let Mortgage Property Tax Youtube

These expenses may include.

. The average 30-year fixed mortgage interest rate is 679 which is a decline of 21 basis points from one. Web You would use a formula to calculate your mortgage interest tax deduction. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Ad Get All The Info You Need To Choose a Mortgage Loan. The taxpayer paid 9700 in mortgage interest. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

16 2017 then its tax-deductible on mortgages. Web 10 hours agothe form of tax breaks to make homeownership more financially feasible. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

Web 19 hours agoMortgage interest rates fell for the second consecutive week as the Federal Reserve announced that its rate hike program may soon end. Homeowners who bought houses before. Web Home mortgage interest.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. In a lump sum in incremental payments or in combination. How It Works in 2022 - WSJ News Corp is a global diversified media and information services company focused on creating and.

The good news if you have a bigger mortgage is. Ad File 1040ez Free today for a faster refund. For tax years before 2018 you can also.

Erika Giovanetti March 27. 15 2017 can deduct interest on loans up to 1 million. Web A single taxpayer in the same 24 tax bracket also wonders if itemizing taxes would result in a lower tax liability.

Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. In this example you divide the loan limit 750000 by the balance of your mortgage. Web You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately.

Todays Mortgage Rates Today the average APR for the. Review the below list to learn which tax breaks you qualify for and how to make the most. Web If you use an electronic tax filing software program you may be prompted for this information automatically.

Form 1098 should be sent to you by your lender and it. Web If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return. I was advised on February 19.

You can take payment from a reverse mortgage in a few ways. Homeowners with a mortgage that went into effect before Dec. Web You can use Bankrates mortgage interest deduction calculator to get an estimate of the type of savings you can expect when you file your taxes.

Choose The Loan That Suits You. Web Most homeowners can deduct all of their mortgage interest. Web Reverse Mortgage Income Isnt Taxed.

Web Mortgage Rates for March 24 2023. Ad Easy Software To Help You Find All the Tax Deductions You Deserve. Web Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

However higher limitations 1. Web Despite more than 10 calls to TurboTax the Mortgage Interest Deduction limitation still NOT working as of March 24 2022. Web Tax break 1.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web Mortgage-Interest Deduction. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules.

Web IRS Publication 936.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Section 24 Property Tax A Complete Guide For Landlords 2022

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

What Is Section 24 A Guide For Landlords

Section 24 Tax Loop Hole Mortgage Interest Relief Tax Deduction

Hf5 Matrix Pdf Mortgage Loan Short Sale Real Estate

Massachusetts Mortgage Interest Deduction Massachusetts Real Estate Law Blog

What Is Section 24 Common Questions About Mortgage Interest Tax Relief Restrictions Less Tax For Landlords

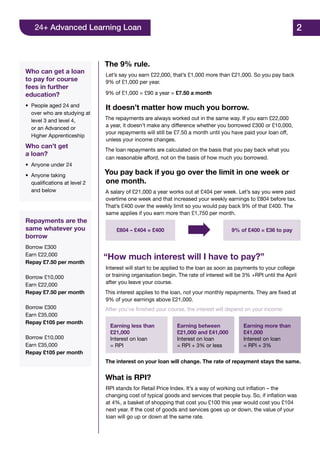

Faqs For Advanced Learning Loans Fe Loans

What Is Section 24 Also Known As The Tenant Tax Alan Hawkins

2 Oakleaf Way Palm Coast Fl 32137 Mls Fc288089 Trulia

Free 10 Property Tax Samples In Pdf Ms Word

Upad Mortgage Interest Relief Calculator How Much More Tax Will You Be Paying

Real Estate Etfs React To Rising Mortgage Rates Part Ii

What Is Section 24 Common Questions About Mortgage Interest Tax Relief Restrictions Less Tax For Landlords

Tax Deductions For Rental Property Massachusetts Real Estate News

What Is Section 24 Common Questions About Mortgage Interest Tax Relief Restrictions Less Tax For Landlords